Investing in amusement rides requires a meticulous balance of market understanding, financial acumen, and operational foresight. Attractions like a large ferris wheel or a carousel offer unique revenue potential but require careful evaluation to optimize returns. This article explores key considerations for amusement ride investments, with a focus on analyzing their financial viability and long-term profitability.

Understanding Market Demand

Before purchasing an amusement ride, such as a ferris wheel for sale, it is essential to assess market trends. Amusement parks, shopping malls, and urban entertainment zones increasingly compete for attractions that draw diverse demographics. Among these, a large ferris wheel stands out as a perennial crowd-puller due to its iconic stature and ability to offer panoramic views, making it a staple in many urban landscapes.

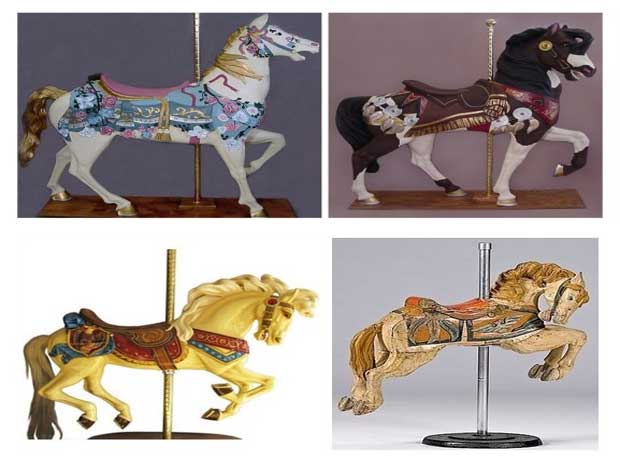

Carousels, by contrast, offer nostalgic charm and are particularly effective in engaging families with young children. Both types of attractions serve distinct markets, and their placement can significantly influence their return on investment (ROI). For example, a carousel for sale might be better suited for a family-oriented park, while a large ferris wheel is ideal for locations with high visibility and foot traffic.

Initial Investment and Acquisition Costs

When evaluating amusement rides, acquisition cost is a critical factor. The price of a ferris wheel for sale can vary widely depending on size, materials, and customization options. A large ferris wheel with illuminated cabins or advanced structural features will command a premium price, but it also tends to generate higher revenue streams through increased ticket sales and advertising opportunities.

Similarly, the cost of a carousel depends on factors such as size, the number of seats, and artistic detailing. While smaller carousels may fit tight budgets, large, intricately designed models often yield greater appeal and revenue potential in high-traffic areas. Investors must calculate not only the upfront cost but also the lifecycle costs, including maintenance, insurance, and eventual upgrades.

Revenue Streams and Diversification

The versatility of amusement rides allows for multiple revenue streams. A large ferris wheel serves as more than just an attraction; it can act as a billboard for local advertisers. Branding opportunities on the cabins, LED light displays, and sponsorship deals significantly enhance revenue potential. Event partnerships, such as seasonal promotions or exclusive rides, further contribute to profitability.

Carousels, while less likely to attract advertisers, are highly effective in driving repeat visits. Their appeal to children ensures steady demand, especially in venues targeting families. Offering package deals or themed rides can also boost revenue. Additionally, rides positioned near concessions or souvenir shops tend to stimulate secondary spending, amplifying overall returns. A large ferris wheel positioned strategically in urban or high-traffic areas can further capitalize on these revenue streams by attracting diverse audiences and creating landmark appeal.

Operational Costs and Maintenance

Operational expenses are a vital consideration in determining ROI. Large ferris wheels typically involve higher costs due to their complexity. Regular inspections, cabin replacements, and mechanical maintenance ensure safety and smooth operation but require a dedicated budget. Furthermore, their towering structure often necessitates additional expenditures for wind and weatherproofing.

Carousels, with simpler mechanics, generally have lower maintenance costs. However, their decorative elements, such as hand-painted horses or intricate lighting, require periodic refurbishment to maintain aesthetic appeal. For investors considering a carousel for sale, understanding these ongoing expenses is critical. While the upfront cost might seem manageable, proper budgeting for future maintenance ensures long-term profitability and sustained audience engagement. Balancing these costs with revenue projections is essential to achieving profitability.

Location and Demographics

The location of an amusement ride is one of the most significant determinants of its success. Urban centers and tourist hotspots are ideal for a large ferris wheel, as these settings provide both visibility and access to high foot traffic. Conversely, carousels are best suited for family-centric venues like suburban parks or smaller amusement centers.

Understanding the demographics of the target audience helps in tailoring the attraction to their preferences. For instance, younger audiences may favor rides with interactive features or modern designs, whereas older visitors might be drawn to classic or nostalgic aesthetics. Proper alignment of the ride’s characteristics with the audience’s expectations enhances ticket sales and boosts ROI.

Financing Options

Purchasing amusement rides often requires substantial capital. Various financing options, such as leasing or installment plans, can ease the financial burden. For instance, acquiring a ferris wheel for sale through a lease-to-own arrangement allows businesses to spread costs over several years while generating revenue from the outset.

Similarly, some manufacturers offer financing packages specifically designed for attractions like a carousel for sale. These agreements often include maintenance services, ensuring that the ride operates efficiently throughout its lifespan. Exploring such options helps investors mitigate risk and improve cash flow management.

Case Studies: Success Stories

Several examples illustrate how strategic investment in amusement rides can yield exceptional returns. A large ferris wheel installed in a metropolitan area often becomes a landmark, attracting tourists and media attention. Its popularity translates into high ticket sales and lucrative advertising deals, covering its acquisition cost within a few years.

Carousels, too, have demonstrated success when strategically placed. A family-owned amusement park that introduced a carousel with customizable themes reported a significant uptick in repeat visitors. The attraction’s ability to connect with its audience emotionally proved invaluable in sustaining long-term engagement.

Conclusion

Investing in amusement rides offers substantial financial rewards when approached with strategic planning and comprehensive analysis. Whether acquiring a ferris wheel for sale or opting for a carousel, understanding market demand, managing costs, and leveraging revenue opportunities are critical to maximizing ROI. By focusing on these factors, investors can transform amusement rides into profitable and enduring assets.